Dear Clients and Friends,

- The NYC residential market has seen a marked slowdown since the frenetic pace of deal activity over 2021. There are several contributing factors to this trajectory, including:

- A return to more typical seasonal sale velocity now that the ‘COVID correction’ period and associated pent-up buyer base (which was largely frozen for much of 2020) has transacted.

- Rising interest rates (more impactful for certain property segments as we discuss in greater detail), financial market and inflation concerns, and global volatility.

- The current market pulse for Manhattan (the number of contracts signed as a percentage of new listings) is approximately 35% – – which indicates a buyers’ market.

- As we consider the state of the NYC market it is important to separate the level of signed contracts from sale pricing. New York City experienced the majority of the residential real estate upswing in 2021/early 2022 as a dramatic increase in the number of contracts signed rather than price increases. We only rose to around 2019 pricing levels compared to many other regions which saw exponentially more drastic upswings in pricing.

- Similarly, to date, the current softening in the market has manifested more in a decrease in contracts signed versus sale pricing.

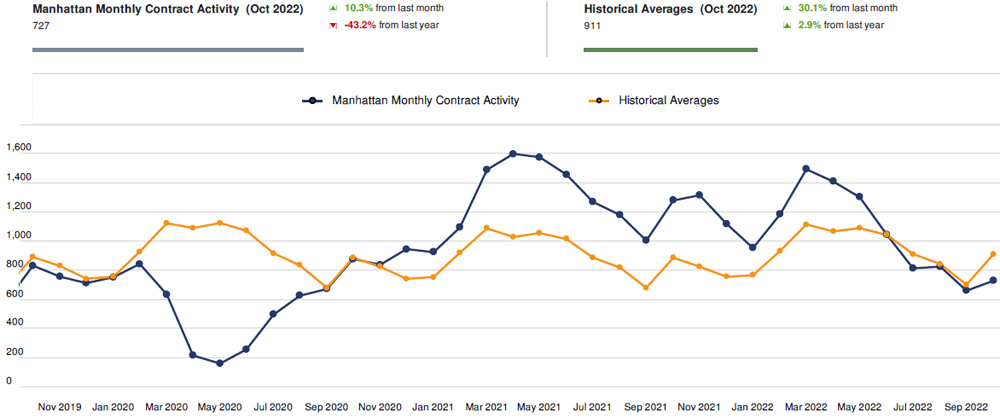

- As evidenced by the chart above, 732 contracts were signed in October 2022, falling short of the October historical average of 911 and approximately 43% below 2021’s supercharged activity. Put differently, contract velocity has currently stabilized a little below 2019/2020 levels and historical norms.

- The supply of new listings has also fallen below historical levels, which has partially offset the decrease in buyer demand and associated downward pressure on pricing. This decrease in listings coming onto the market is due to a normal seasonal leveling off of inventory as well as certain sellers waiting to list their property if current uncertainty is not allowing them to transact at their desired ‘number’. The leveling off of BOTH supply and demand vs. historical averages has created some measure of counter-balance.

- We are witnessing a more measured pace of transactions in which it is more critical than ever for brokers to bridge the gap between many buyers’ and sellers’ perception of the market. While the market is slower and buyers face less competition, there remains a relative lack of supply and most sellers are not willing to hit a materially lower bid. Furthermore, the average rent in Manhattan of $4,300 remains well above historical averages – so for those who need to live somewhere in NYC it may still make more sense to buy vs. rent. Potential property investors are also benefiting from higher rental yields.

- Properties which are experiencing the most robust interest are unique prime-location assets that only come to market periodically and cater to primary-resident use. These homes tend to have well-capitalized buyers that are less interest rate and liquidity sensitive and more urgency to transact when they see what they want.

- Purchasers still favor renovated product given the approximately ~40% increase in renovation costs post-pandemic and their desire to have a firm move-in date timeline.

- There is currently an opportunity for buyers to purchase the best property in a more thoughtful and deliberate manner. Even those who wish to finance can secure the most accretive long-term residential real estate investment now with less competition, and then refinance when interest rates decrease. As they say, marry the property and date the rate…

Select Featured Novack Team Listings

Please don’t hesitate to reach out to us with any questions, or on any of your real estate needs.

Warm Regards,

Alex and Sybille

917.562.8283

Alexander.Novack@Sothebys.Realty